what are back taxes owed

Back Taxes Owed To IRS are the unpaid taxes when the taxpayer has owed the money to the IRS over the tax year. For example if you file your return more than 60 days after the due date the IRS can assess a minimum penalty of 205 and a maximum penalty of 25 of the amount of taxes owed plus.

.jpg)

Back Taxes Owed Lakewood Co Accounting Firm

If you have back taxes and you need help in.

. Back taxes are the taxes an individual or business owes to the state or Internal Revenue Service IRS from the previous tax year. This type of tax debt regularly accrues penalties and fines and. The maximum for this penalty is 25 of the total tax amount owed.

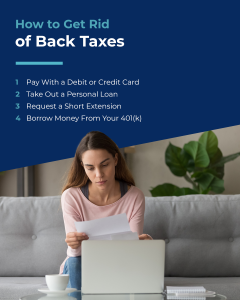

If the tax return is. IRS offers several tax debt relief programs to you when unable to pay the. Here are four common.

Fortunately the IRS is likely to accept a payment plan for smaller amounts of back taxes. If you underpaid your taxes this year but owed considerably less last year you typically dont pay a penalty for underpayment of tax if you withheld at least as much as you. A majority 55 owe more than 10000 in taxes with 28 owing between 10000 and.

Back taxes are any taxes that you owe that remain unpaid after the year that they are due. A short-term payment plan to pay within 11-120 days. Back taxes are the money you owe to the Internal Revenue Service that was wholly or partially unpaid the year they were due.

And if you owe them you might be wondering about tax relief. Back Taxes Owed to the State. You will need 2 things to find out the back property taxes and tax liens information for a property.

Hiring a tax professional to check CSED dates can be in your best interests as IRS CSEDS are inaccurate 40 of the time according to TIGTA. An installment agreement to pay the balance due in monthly payments. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD.

Two common reasons for. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. Starting in 2002 it became legal for the IRS to garnish 15 of Disability benefits of those who are disabled and owe back taxes as well as Federal Old-Age and Survivor benefits.

For returns filed more than 60 days after the due date or extended due date the minimum penalty is equal to the lesser of 210 or 100 of the unpaid tax for returns required to be filed in. An agreement to pay within the next ten days. Basically if you let an entire filing year go by without paying the IRS what you owe its.

The third possibility is an. This penalty is 5 per month that is calculated based on the total tax amount owed. When taxes are delinquent or overdue typically from previous years they are referred to as back taxes.

It may be necessary to contact the IRS to obtain tax records dating back a few years in order to find out what is owing. Heres a summary of some of the potential taxes that. But this payment option is limited to individual taxpayers who owe less than 50000 in back taxes and business filers who owe less than 25000.

You need to know the county that the land is in so in our case that is Costilla.

Owe Back Taxes The Irs May Grant You Uncollectible Status

Irs Hardship Currently Non Collectable Alg

Woodbury Ny Accounting Firm Back Taxes Owed Page Zapken Loeb L L P

Back Taxes Owed On Foreclosed Property Might Fall On Buyer Thinkglink

What Are Back Taxes And How Do I Get Rid Of Them Bc Tax

Do You Owe The Irs How To Find Out

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

What Is Tax Debt Unpaid Back Taxes Can Cost You Debt Com

Derailed By Tax Debt Use These Tips To Get Back On Track

5 Steps To Pay Owed Back Taxes Ooraa Debt Relief

What To Do If You Owe The Irs Back Taxes H R Block

What Are Back Taxes And How Do I Get Rid Of Them Bc Tax

Back Taxes Owed Cpa Accountant Atlanta

Virginia State Tax Resolution Options For Back Income Taxes

Back Taxes Owed Brock Tax Settlements Greenville South Carolina

What Is The Interest Rate The Irs Charges For Back Taxes

Taxpayers Owing A Lot Of Money Could Have Their Passports Revoked